According to EMEA technical director at Future Lighting Solutions, Francois Mirand, the adoption of LED technology has reached 20 to 30% of the professional market while Jason Middleton, the lighting divisional marketing manager with distributor Anglia, is forecasting growth of 4 to 6% over the next few years.

Both believe the adoption of LED technology started to accelerate around 2010, after a period maturation in terms of performance and efficiency.

“Because of industry energy regulations, lumens per watt is a key driver in this market,” Middleton said.

“While the pricing of LED chips took several years to mature it is now reaching a ‘tipping point’,” added Waq Bhatti, managing director of retrofit LED technology specialist LED Eco Lights.

Employing more electronics than traditional lighting sources, Middleton believes LED lighting should be firmly anchored in the electronics sector. Mirand, however, believes that while there is a convergence between LED lighting and electronics – LEDs are assembled on a PCB and can provide more control and system functionality – that’s just ‘a parallel evolution to the emergence of the solid-state lighting technology’.

“Lighting is still lighting and they are two very different worlds.”

Bhatti agrees. “I still see a gap between the two industries. While LEDs are all about electronics, how we use them and design them into our world is another matter entirely.”

That gap is hard to bridge and many lighting companies struggle with issues such as PCB design. And that provides a role for distributors like Future Electronics, which can support those companies lacking the resources or the expertise to build a lighting solution. “We bring integration expertise,” said Mirand. “Modules can be used as a bulb around which luminaires can be built – it’s about bringing the right light that will fit into the luminaire design. For some, we can almost do the luminaires for them.”

Future distributes Flashnet’s inteliLIGHT (pictured left), a LoRaWAN-compatible smart streetlighting solution, which can control an entire streetlighting grid, as well as managing scheduling and maintenance applications.

The rapid evolution of LED lighting technology is a major challenge, says Mirand. Companies redesign continuously because of product obsolescence as well as looking to leverage the very latest technology developments to remain competitive.

“They have to consider redesigning over a cycle of between 18 months and three years,” he suggests.

Bhatti agrees that LED Eco Lights’ biggest challenge is future-proofing its designs, so they can handle increased heat and light energy; especially when LED chip performance is doubling over time.

Thermal management is a significant problem for LEDs, with more heat generated by higher currents compromising performance and possibly leading to device failure.

Designer of retrofit LED lamps and luminaires LED Eco Lights claims to be the first British company to integrate MagLev Fan cooling technology – near-frictionless two-stage variable speed centrifugal compressors – into its G360 LED SON range of lamps.

“We have incorporated a copper cooling column into our GX1 LED High Bay range, which houses ‘phase-change’ liquid in its core, for thermal management, prolonging the LED life,” said Bhatti.

Bhatti believes the next step for LED lighting will be the discovery of lighter and cheaper metals to cool the LEDs more efficiently.

Tool support

Future has two tools which it claims can help customers save hours when it comes to LED systems engineering and simulation calculations – Lighting System Creator and Usable Light Tool.

Lighting System Creator provides guidelines to help the user find the right solution for their application. It gives a selection of components and modules, with variable levels of integration, as well as cooling solutions, LED drivers and power supplies from which companies can build their project.

Usable Light Tool is described as a sophisticated LED simulator, which enables the customer to simulate an actual LED source performance in the application conditions.

“LED manufacturers don’t always specify their products in the same conditions, so comparison is made very difficult and evaluating different solutions takes a lot of time. Our tool provides details on all the necessary parameters,” Mirand asserted.

While Anglia supplies components, rather than modules, it says it can help its customers design a complete solution, from the initial design right through to the final production and supply chain.

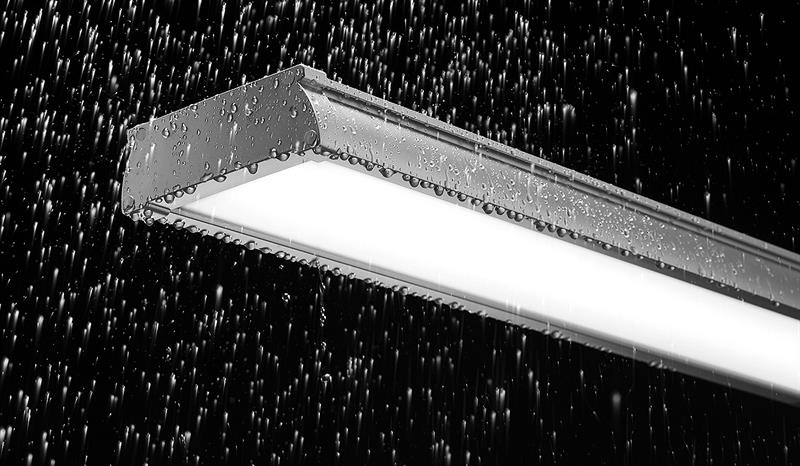

According to Middleton, there are two sides to the UK market – mid-power, for those making linear strip designs – and high power, which Anglia’s main LED franchise from Cree targets. “Low cost mid-power solutions are certainly very strong in the UK, but it’s not an area on which Cree is focusing,” he added.

Cree has designed its silicon carbide (SC5) technology, said to achieve better efficiency and greater lumen output. Its latest release, the XLamp XHP70.2, can deliver up to 9% more lumens and 18% higher lumen/W than its first generation XHP70 LED, which it claims has up to a 58% higher lumen density than the closest competitor LED in a 7 x 7mm footprint.

“Cree’s strategy is to look at system costs, rather than LED costs,” Middleton explained. “If a competitor is offering a solution with 25 LEDs, Cree may be able to build the same thing using 10 to 15 LEDs. Whilst the LED costs might be the same, the system can be smaller.”

Middleton believes the IoT and connectivity will be key drivers for LED development in the UK. “And it’s not going to be about the LED design, rather how that can be incorporated into other products.”

Potential applications could include indoor lighting solutions capable of voice recognition and able to adjust to the levels of natural light.

All three companies believe the industry is still focused on closing the cost gap and in reducing the bill of materials associated with system assembly. “There are still areas where LEDs aren’t cost effective enough to replace incumbent technology,” said Mirand, but he does see an evolution in lighting and in applications using non-visible light, such as infrared and ultraviolet, where the LEDs can be ‘tuned’ for better effect.

LED Eco Lights is a specialist in retrofitting LED technology into existing lighting installations

He sees large plant production factories using agriculture LED lighting to help alleviate growing supply and demand imbalances as well as helping to alleviate, in part, climate change.

Everlight, for example, has developed a portfolio of LEDs targeting the agricultural space. Two medium-power LEDs, the EAHP3030 and EAHP2835, can be used in plant factories or vertical farms.

While it’s crucial that customers have access to the appropriate lighting solutions i.e. in terms of wavelength, power and size, it is also critical that manufacturers of agriculture LED lighting provide more accurate LED lifespans.

“All told I believe that ultraviolet will become more prevalent in agriculture but also in industrial applications, sanitisation and water purification. The aim being to reduce the excessive use of chemicals currently being used.

“LEDs will provide more energy efficient green lamps and enable crops to be grown closer to the end user,” Mirand believes.