Out of the data that’s collated ecsn produces its annual UK & Ireland Electronic Components Market Forecast which has been made difficult this year by current market conditions and a turbulent geopolitical situation that has made forecasting twelve months ahead somewhat uncertain.

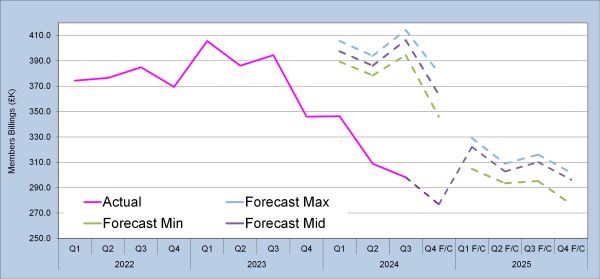

“The decline in growth in the UK and Ireland electronic components markets throughout 2024 exceeded the decline predicted in the Forecast ecsn issued at the end of last year,” explained ecsn chairman Adam Fletcher. He continued, “At the time we forecast single digit ‘Billings’ (sales revenue) growth in the range (1.6%)-to-4.1% in 2024 compared to 2023, but we now believe that the outcome is likely to be a decline of (19.7%), driven primarily by weak demand and an industry-wide inventory overhang”.

Fletcher said that the decline and significantly reduced demand could be attributed to a number of adverse factors following the global pandemic, including a period of significant customer over-ordering, increasing geopolitical tensions resulting from the Russian invasion of Ukraine, multiple armed conflicts in the Middle East and the additional sanctions imposed because of the ongoing US / China trade war.

“The net result is a glut of electronic components with both components manufacturers and their authorised distributors,” said Fletcher. “Our members report that their customers continue to struggle to rebalance both their artificially inflated in-house inventory and supplier order books in the face of weaker demand from their end customers”.

Much of the ongoing inventory problem in the semiconductor sector has been caused by the implementation on Non-Cancellable, Non-Returnable Contracts (NC/NR) between manufacturers, their authorised distributors and their customers.

Customers were seemingly willing to sign these contracts for what they must have known were inflated purchase volumes in the hope that they would secure supply (perhaps without fully considering their liability). As semiconductor supply came back on stream the goods ordered where shipped and they had to accept delivery and pay for the products they ordered, which are now sat on shelves as excess inventory until it is consumed.

The rapid and violent swings in demand and supply over the past few years have left many customer organisations with little credible data on which to base their material forecasts going forward and facing long components manufacturer lead-times they significantly over-ordered.

In a normal reasonable growth market, the Book-to-Bill ratio in the UK market would be approximately 1.05:1 but in 2023 it escalated, hitting a peak of 1.45:1, which was both unprecedented and unsustainable.

The Electronic Components Supply Network in common with many other industry analysts warned of ‘Bookings Bubble’ and a looming problem of ‘inventory indigestion’.

As Fletcher explained, “Until this inventory hangover is consumed, growth will not return to the electronic components market in the UK or anywhere else”.

In its Forecast for 2024 delivered at the end of last year the association admitted that the market conditions for 2024 were difficult to predict because the product shortages and extended lead-times in 2021 and 2022 had caused the entire supply network to become overstocked, which was masking the real underlying demand.

“We were right when we said that the market was difficult to judge but we were completely wrong in predicting the demand for electronic components in 2024”, admitted Aubrey Dunford, ecsn Market Analyst. “Global economic conditions were suppressing demand much more than our members realised, triggering much higher overstocking throughout the supply network than we expected.”

“Bringing global inventory back in-line with current demand levels throughout the electronic components supply network, is proving to extremely difficult, however the underlying demand for electronics in virtually every area of modern life continues to increase, which is why ecsn is forecasting a return to growth in 2025. Sadly, we now believe the upswing will not begin until the later part of 2025, although the timing and scale of this growth is still difficult to determine.”

According to Dunford despite the upturn indicated by the global semiconductor sales, growth is being driven by demand for the specialised memory products to support leading edge GPU’s operating Large Language Models (LLM) required for the latest Artificial Intelligence (AI) applications.

Other sectors of the semiconductor market are not currently seeing the same upturn with many manufacturers holding on elevated inventory of semiconductors, particularly microcontrollers, standard logic and analogue devices.

“The electro-mechanical sector including interconnect seems to the first to get more into balance”, continued Dunford. “2024 is likely to close out showing that the UK electronic components DTAM (Distributor Total Available Market) will have declined by nearly 20%, which is significantly lower result than we had expected”.

Throughout 2023 as products were becoming more available and back orders were being fulfilled, ecsn members saw fa declining ‘Book-to-Bill’ ratio’. In October 2023 members believed that the ratio had passed its nadir in the middle of the year however, Bookings continued to decline at the start of 2024 - especially for semiconductors - and although they have since improved, the ratios have remained below unity for the whole of the year to date, prompting ecsn members to predict that the market will continue to decline in the first half of 2025.

“The B2B ratios reported by the other trade associations in Europe reveal that the UK has fared much better throughout 2024 than most other countries”, Dunford said. “This is yet further indication that the supply network remains overstocked. The European market is forecast to remain weak throughout 2025, especially in Germany where the slowdown in the automotive market and demand for industrial equipment from their main export market in China are having a dramatic effect.”

Turning to its forecast for 2025 ecsn is predicting that the UK & Ireland electronic components market will continue its negative growth pattern in 1H’25, with ‘Billings’ (Sales Revenues) declining between (8.7%)-to-(2.6%), and showing a mid-point decline of around (4.6%). In the second half of the year the association predicts that ‘Billings’ will recover modestly in the range (1%)-to-9% to give an outcome for the full year in the range (4.9%)-to-2% but showing zero growth at the mid-point compared to the previous year.

Despite the much larger correction in the inventory levels Dunford sees many reasons to be optimistic about the industry prospects for 2025/6.

“Many areas are continuing to grow as innovation creates new market opportunities. In the UK, and indeed in most of Europe where the component market is driven by the industrial, professional equipment,” Dunford said. “Military and aerospace for obvious reasons remains very strong, although they represent a small proportion of the total market. Continued weak customer demand for electric vehicles (EV) has negatively impacted the Automotive sector but will improve, probably as a result of additional direct consumer subsidies along with increased investment in man, but current emission targets look unlikely to be met. The roll-out of 5G handsets and related infrastructure is continuing to enable more IOT applications.”

The deployment of Artificial Intelligence (AI) is rapidly increasing in mobile phones and computing but is probably 2-to-3 years away from making a major impact on Edge computing and new applications outside of datacentres that will be purchased in the UK/Ireland market, according to Dunford.

Despite predicting essentially flat growth in 2025, Fletcher expressed confidence that the mid- and long-term trajectory for UK/Ireland and global electronic components markets continues to be up and that stronger underlying growth will return to global electronic components markets at some point in 2026.