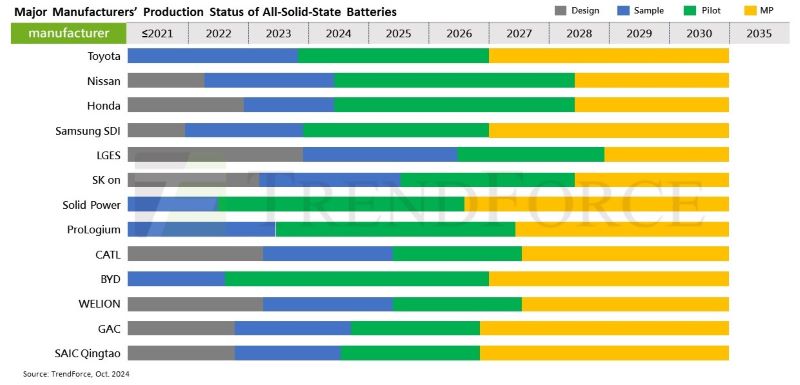

TrendForce’s latest findings found that a growing number of manufacturers across the globe, such as Toyota, Nissan, and Samsung SDI have already begun pilot production of all-solid-state batteries, and it estimates that production volumes could have GWh levels by 2027 as these companies race to scale up production.

Solid-state batteries offer improvements in safety and energy density, but they continue to face significant challenges, including high production costs, complex manufacturing processes, and a lack of a mature supply chain.

Semi-solid-state batteries, currently deployed in EVs, have reached GWh-level scale installation, with cell energy densities ranging from 300–360 Wh/kg. The initial price of semi-solid-state cells exceeds CNY 1/Wh due to small production scales and the relative immaturity of manufacturing technologies.

TrendForce anticipates that with increased production scale and technological advancements, the comprehensive cost of semi-solid-state batteries could drop below CNY 0.4/Wh by 2035.

All-solid-state batteries (ASSBs) are moving from prototype sample cells to engineering-scale production and are also expected to encounter high early-stage production costs that could raise initial product prices.

TrendForce projects that, by 2030, if the scale of all-solid-state battery applications surpasses 10 GWh, cell prices could fall to around CNY 1/Wh. By 2035, cell prices could decline further to CNY 0.6–0.7/Wh with rapid, large-scale market expansion.

SSBs based on different solid-state electrolytes are being developed. Polymer-based SSBs are relatively mature and offer cost advantages; for example, PEO-based polymer Li-metal SSBs have already been commercialised in parts of Europe. However, polymer-based SSBs still need to adopt composite electrolyte materials with a wider voltage tolerance and higher ionic conductivity to expand commercialisation.

TrendForce noted that oxide solid-state electrolytes offer good stability and moderate costs but are difficult to process. Additionally, the “solid-solid” contact between the electrolyte and the cathode/anode active materials leads to higher internal resistance.

Sulfide-based SSBs show particularly strong potential due to their ionic conductivity, which is closest to, and may even exceed, that of liquid electrolytes. This performance potential has attracted the attention of numerous companies, including Toyota, Samsung SDI, LGES, SK On, CATL, and BYD.

However, sulfide electrolyte materials remain costly, are unstable in air, and are highly sensitive to moisture, necessitating strict environmental controls and adding complexity to the production process.

While TrendForce said that it expected the development of SSB technology to be cautious it remains optimistic. Although key performance indicators such as charge-discharge rates and cycle life have not yet reached commercialisation standards - and current costs remain uncompetitive with liquid li-ion batteries - SSB costs will improve significantly as production scales up, owing to strong government policies and capital investment.