According to SEMI, growth is being fuelled by seasonal factors and strong demand from investments in AI data centres. However, the consumer, automotive, and industrial segments are experiencing a slower pace of recovery.

The growth trend is expected to continue into the fourth quarter of 2024.

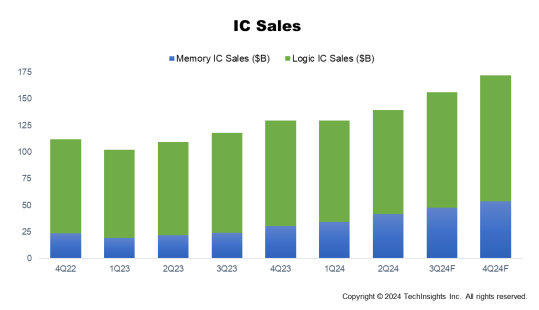

After declining in the first half of 2024, electronic sales rebounded in Q3 2024, growing 8% QoQ, with a projected QoQ increase of 20% in Q4 2024. IC sales also rose by 12% QoQ in Q3 2024 and are expected to grow another 10% in Q4 2024.

Overall, IC sales are forecasted to increase over 20% in 2024, primarily driven by memory products due to price improvement across the board and strong demand for data centre memory chips.

Similar to the electronics sales, semiconductor capital expenditures (CapEx) decreased in the first half of 2024, but the trend is now turning positive starting in Q3 2024.

Memory-related CapEx is surging 34% QoQ and 67% year-on-year (YoY) in Q3 2024 reflecting improvement in the memory IC market compared to the same period of the last year. In Q4 2024, total CapEx is expected to jump 27% relative to Q3 2024 levels and 31% YoY, with memory-related CapEx leading this growth at 39% YoY.

The semiconductor capital equipment segment remains strong and is performing better than previously expected due to substantial investments from China and increased spending for high-bandwidth memory and advanced packaging.

Wafer Fab Equipment (WFE) spending increased 15% YoY and 11% QoQ in Q3 2024 with China’s investment continuing to play a significant role in the WFE market. Additionally, both the Test and the Assembly and Packaging segments experienced impressive YoY increases of 40% and 31%, respectively, in Q3 2024, and this growth is anticipated to continue for the remainder of the year.

In Q3 2024, installed wafer fab capacity reached 41.4 million wafers per quarter (in 300mm wafer equivalent) and is projected to rise by 1.6% in Q4 2024.

Foundry and Logic-related capacity continues to show stronger increases, growing 2.0% in Q3 2024 and is projected to rise 2.2% in Q4 2024 driven by capacity expansion for both advanced and mature nodes.

Memory capacity increased 0.6% in Q3 2024 and is forecasted to maintain the same pace of growth in Q4 2024. This growth is driven by strong demand for high bandwidth memory (HBM) but is partially offset by process node transitions.

“The semiconductor capital equipment segment continues to exhibit growth momentum, bolstered this year by strong investments from China and increased spending on advanced technologies,” said Clark Tseng, Senior Director of Market Intelligence at SEMI. “Additionally, the continued expansion of fab capacity, especially in the foundry and logic segments, underscores the industry’s commitment to meeting the growing demand for advanced semiconductor technologies.”